Loan Officer News

Loan Officers Hotline: Get Expert Advice Today!

rICKY'S TAKE ON cONSTRUCTION LOANS

Southend WEEKLY MORTGAGE UPDATE!

If this topic doesn't light your fire, you have wet wood! Based on popular demand, we are talking about land & construction this week on our path to make you dangerous with knowledge. If you want to discuss any of these topics in more depth, I'm only a phone call away at 518-796-3132!

WE ARE HIRING!!!

If you know any Loan Officers looking for a new home with super competitive products feel free to give them my info or vise versa.

Based on Freddie Mac national data, the rates are at 6.87%. This is a few weeks in a row they are trickling down. Something we all need to check ourselves on is the fact that you and I are much more sensitive to rates than our consumers. It's good that we know a bit of what is going on, but stressing rates to clients has not shown positive results compared to talking about a comfortable monthly payment. "Your new house payment is going to be higher than your current rent now... But in 5 years when rent keeps going up, your mortgage won't. Imagine what rent is going to be in 15 years.

rICKY'S PROCESS FOR INVESTMENT PROPERTIES

Based on Freddie Mac national data, the rates ended last week at 6.95% for a 30-year mortgage. This makes two weeks in a row that we have rates below 7!!! The market is feeling positive about the future housing market even with the Fed's firm stance on not rushing to lower rates.

This week we are talking about the thought process and action plans that some investors like myself are implementing. This is a great segue from last week's topic on the loans available to purchase properties. Now we know what to do with them. Last week’s flyer on the loan types is attached below!

Free Grant - No Repayment

This FHA down payment assistance grant is completely forgiven after making 6 on-time payments. The grant is equal to 3.5% of the purchase price and can be combined with seller concessions, up to 6% to make this a true $0 cash to close purchase. This grant can be used on all property types 2 units or less….There is no income limit, you do not have to be a 1st time home buyer and the credit score typically takes a 620 to qualify but we have seen as low as 580 work. This loan affiliated with this grant has a fixed 7.75% interest rate and costs 2 points (2% in fees). It can be refinanced after making 6 payment so the clients are into the lowest house payment available to them like they made the original down payment on their own.

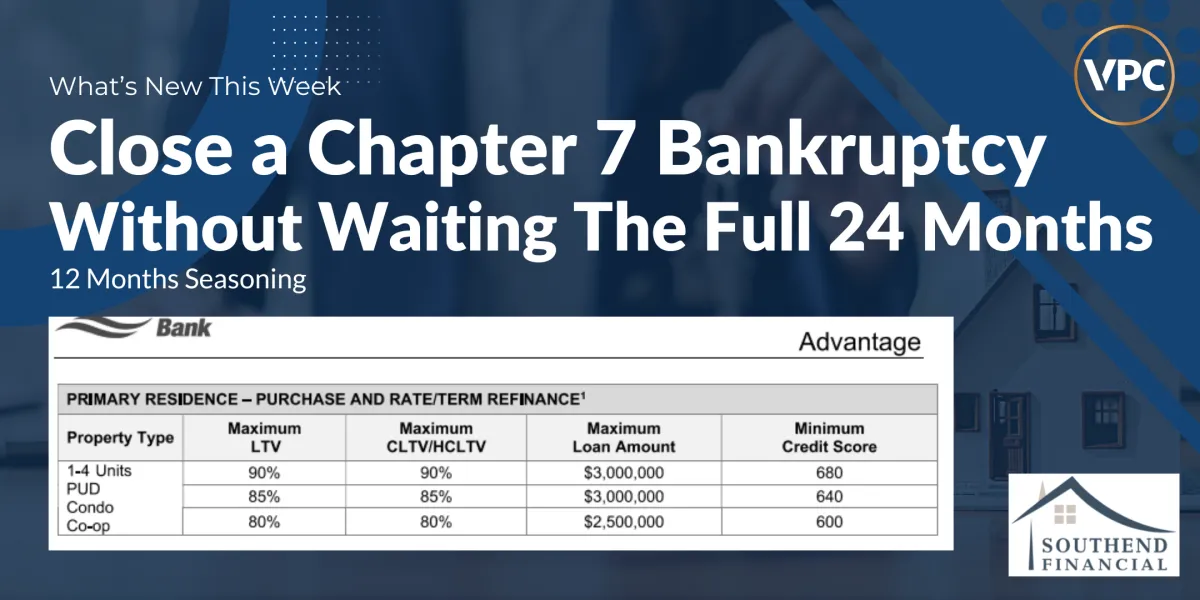

Unlock Faster Bankruptcy Closures with Our New Program!

Exciting news for loan officers! Say goodbye to long waiting periods for Chapter 7 bankruptcy closures. Introducing Flagstar's groundbreaking program, where we can now close Chapter 7 bankruptcies in just 12 months—half the time of traditional methods. This means quicker resolutions for your clients and smoother processes for you. Don't miss out on this opportunity to streamline your operations and provide exceptional service. Contact our hotline today to learn more and get started!

Email [email protected] or call (980) 999-2220.

Making Homeownership more Accessible For Low Income Borrowers

Email [email protected] or call (980) 999-2220 to learn more.

This FHA down payment assistance grant is completely forgiven after making 6 on-time payments. The grant is equal to 3.5% of the purchase price and can be combined with seller concessions, up to 6% to make this a true $0 cash to close purchase. This grant can be used on all property types 2 units or less….There is no income limit, you do not have to be a 1st time home buyer and the credit score typically takes a 620 to qualify but we have seen as low as 580 work. This loan affiliated with this grant has a fixed 7.75% interest rate and costs 2 points (2% in fees). It can be refinanced after making 6 payment so the clients are into the lowest house payment available to them like they made the original down payment on their own.

Email [email protected]

or call (980) 999-2220 to learn more.